What Does Fortitude Financial Group Do?

Getting My Fortitude Financial Group To Work

Table of ContentsThe Best Guide To Fortitude Financial GroupUnknown Facts About Fortitude Financial GroupOur Fortitude Financial Group IdeasOur Fortitude Financial Group StatementsNot known Facts About Fortitude Financial Group

Note that numerous consultants won't manage your possessions unless you fulfill their minimal needs. When picking a financial advisor, locate out if the specific follows the fiduciary or suitability requirement.If you're looking for financial suggestions but can not pay for an economic advisor, you could think about using a digital financial investment expert called a robo-advisor. The broad area of robos spans systems with access to monetary consultants and financial investment monitoring. Encourage and Improvement are 2 such instances. If you fit with an all-digital platform, Wealthfront is another robo-advisor option.

Financial experts may run their own firm or they may be component of a larger workplace or financial institution. Regardless, a consultant can aid you with everything from developing an economic strategy to spending your money.

Fortitude Financial Group Fundamentals Explained

Think about working with a economic consultant as you produce or modify your financial plan. Locating an economic expert does not need to be tough. SmartAsset's cost-free device matches you with as much as 3 vetted financial advisors that offer your area, and you can have a complimentary introductory phone call with your advisor matches to make a decision which one you really feel is appropriate for you. Check that their qualifications and abilities match the services you desire out of your expert. Do you want to discover more concerning financial experts?, that covers principles bordering accuracy, dependability, editorial independence, expertise and neutrality.

A lot of people have some psychological link to their cash or things they purchase with it. This psychological link can be a primary reason why we may make inadequate economic choices. A specialist financial consultant takes the feeling out of the formula by offering unbiased recommendations based upon knowledge and training.

As you experience life, there are monetary choices you will certainly make that may be made more quickly with the support of a specialist. Whether you are trying to lower your financial obligation lots or intend to start planning for some long-lasting objectives, you could gain from the services of an economic expert.

The Best Guide To Fortitude Financial Group

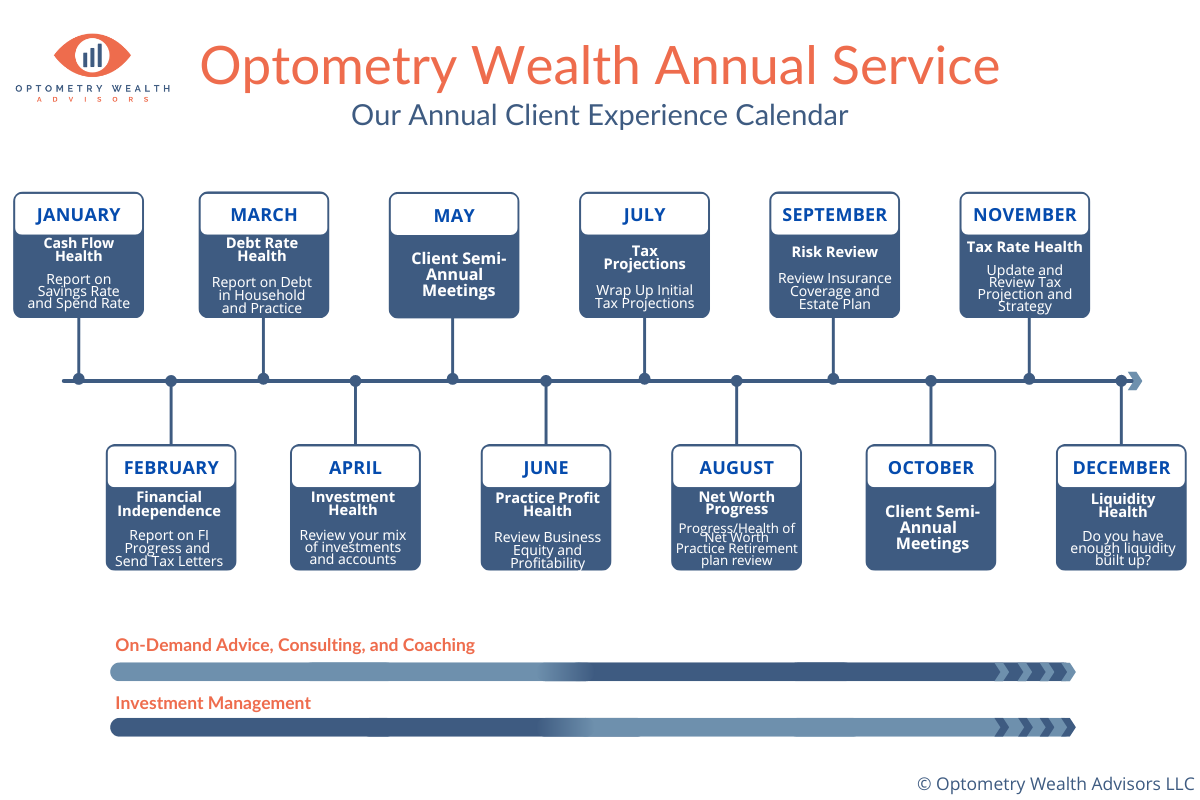

The basics of investment monitoring consist of buying and selling financial possessions and other financial investments, yet it is a lot more than that. Handling your investments includes recognizing your brief- and long-term objectives and utilizing that info to make thoughtful investing choices. A financial consultant can give the data essential to help you diversify your financial investment portfolio to match your preferred degree of danger and fulfill your financial goals.

Budgeting provides you an overview to just how much money you can spend and exactly how much you need to save monthly. Adhering to a budget plan will certainly aid you reach your short- and long-lasting monetary goals. A monetary expert can aid you describe the action steps to take to establish up and keep a spending plan that works for you.

Often a clinical expense or home repair can suddenly contribute to your financial obligation tons. A specialist debt monitoring plan assists you pay off that financial obligation in the most monetarily advantageous means possible. A monetary consultant can help you assess your debt, prioritize a debt repayment method, supply choices for financial obligation restructuring, and describe an alternative plan to additional info better take care of financial obligation and satisfy your future monetary goals.

The Greatest Guide To Fortitude Financial Group

Individual cash circulation analysis can inform you when you can afford to acquire a new car or just how much money you can add to your savings monthly without running short for needed expenditures (Financial Services in St. Petersburg, FL). A monetary expert can help you plainly see where you invest your cash and then use that understanding to help you comprehend your economic health and exactly how to boost it

Threat administration solutions recognize potential dangers to your home, your automobile, and your family, and they assist you put the ideal insurance coverage in position to alleviate those risks. A monetary advisor can assist you create a method to secure your earning power and minimize losses when unexpected points occur.

8 Simple Techniques For Fortitude Financial Group

Decreasing your tax obligations leaves more money to contribute to your financial investments. Investment Planners in St. Petersburg, Florida. An economic advisor can help you utilize philanthropic offering and financial investment strategies to reduce the quantity you have to pay in tax obligations, and they can reveal you just how to withdraw your money in retired life in a method that additionally decreases your tax worry

Even if you didn't begin early, university preparation can aid you place your youngster via university without facing suddenly large expenses. An economic expert can guide you in understanding the best means to conserve for future university expenses and exactly how to money possible voids, clarify just how to lower out-of-pocket university prices, and suggest you on eligibility for financial assistance and gives.